Unless you have been living off-the-grid, you know by now that Valdemar Putin has ordered the invasion of Ukraine. It’s never pleasant reaching out to you during such a tragic event that will leave a permanent human toll, especially when our focus will naturally be on the effects this event may have on our portfolios. However, we have already received some client questions on the topic and thought it was time to address the subject on a broader scale.

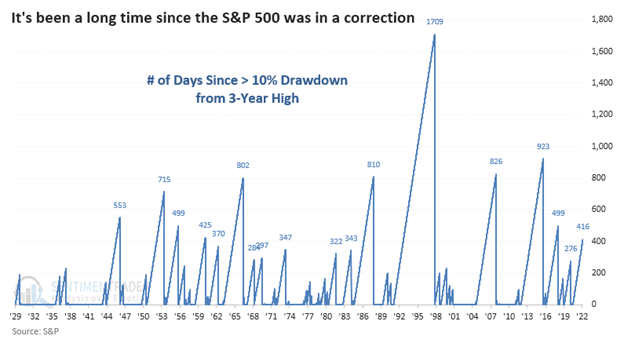

The stock market has experienced the first correction (loss of 10% from prior highs) in 416 days. For comparison, here are all the durations of bull markets in between corrections since 1929.

It’s been a while to say the least. The duration of this last bull run has been in the top half in length since the roaring twenties (1928). Quite a feat considering all the uncertainty we’ve encountered over the past year or so. Bearing the brunt of this downfall has been technology stocks, many of which are down over 20% on average.

While we don’t know exactly when this correction in the stock market will end, we can look back to other periods of time where war, or significant attacks, have broken out.

As you can see, on average, war has brought down the stock market by 5% and took 22 days. Just 47 days later the stock market would have gone on to recover all those losses. While history doesn’t always repeat itself, when it comes to the market, it often rhymes.

This attack is unique and has ramifications that will send shockwaves in the oil and gas industry, but we’ve had conflicts in oil rich regions now for decades. It comes at a time where the U.S. has access to more oil reserves than ever in its past. While we will likely have higher oil prices, we don’t expect the worst-case scenarios of $200 per barrel of oil.

We continue to rely on our portfolio rebalancing process to guide your portfolio through events such as these. For many of you, we have begun to purchase stocks on the weakness that we’ve seen in the stock market. Our disciplined process forces us to buy low. While the timing will never be perfect, the process of buying low and selling high usually lends to better risk-adjusted returns over long periods of time.

If it provides any comfort, your portfolios have no direct exposure to Russia or Ukraine. We have purposely avoided less politically stable countries to invest your assets, instead favoring first world countries with strong and diversified economic systems. While some of the companies within the broad-based index funds may have exposure in war-torn regions, they are unlikely to be meaningful enough to affect your portfolio.

Remember, we prepare for these stock market scenarios in your financial plan with our “Bad Timing” scenario and can adjust your plan as needed. We encourage any questions you may have and look forward to updating you with more positive news in the future.

R.W. Rogé & Company, Inc. is a fee-only financial planning and wealth management firm serving clients locally and virtually across the country, with Long Island, New York, Beverly, Massachusetts, and Naples, Florida office locations. We help clients Plan, Achieve, and Live® the life they want since 1986. To learn more about how we do this, click here.