A friend and financial advisor journalist, Bob Veres, sent out a letter to his subscribers of “Inside Information” this week, wondering why previous flu epidemics in the U.S. did not require the draconian measures we are taking today to deal with the COVID-19 virus situation.

Here are the recent flu epidemics Bob wrote about:

“Truth is, we’ve actually experienced quite a few major flu epidemics, some of them coming from Asia, which ultimately had very little impact on our economy and our markets. Before most of our times (1957-58), the first “Asian flu,” the H2N2 virus, caused roughly two million deaths worldwide, and caused barely a ripple in the economy or the markets—and certainly not social distancing or major runs on toilet paper.

The 1968-69 “Hong-Kong flu” (H3N2 virus) killed a million people globally. It didn’t stop the economy in its tracks or trigger social distancing. The grocery aisles remained full and people still went to school and work.

Remember the 1997 “Bird flu?” The H5N1 epidemic caused a worldwide scare, but once again, the economy moved on without a ripple. Then came SARS—Severe Acute Respiratory Syndrome, caused by a novel bug called a coronavirus. In 2003, it roared out of Asia and spread to more than two dozen countries, infecting more than 8,000 people and killing 774. But again, the social/economic impact was minimal.

The 2009 “Swine flu” (H1N1 virus) originated in Mexico, mixed with a Eurasian swine flu virus from Europe and killed more than 18,000 people around the world. Turns out 2009 was a good year for the markets and the economy, as it recovered from the Great Recession.”

While they are alarming and often unexpected, pandemics are not a novel issue. According to a recent Morningstar article, both the 1957 Asian Flu and the 1968 Hong Kong Flu pandemics had a RO (reproduction number) of 1.9. The RO measures how contagious a disease is, and a higher RO means a sharper rise and fall of infection rates with a shorter duration of the outbreak. By comparison, the typical flu has a RO of 1.5. Recent studies are placing COVID-19 with a RO of 2.2 – which means it’s slightly higher than the common flu. Therefore, if the RO for Covid-19 is correct, we can expect a sharper rise in infection rate but a shorter duration of the outbreak than the regular flu.

Bob’s information only went up to 2009, but I remember reading, somewhere, that the 2017 Flu Epidemic was the worst in modern history. So, I did some research to try and find information that would put it in perspective for us.

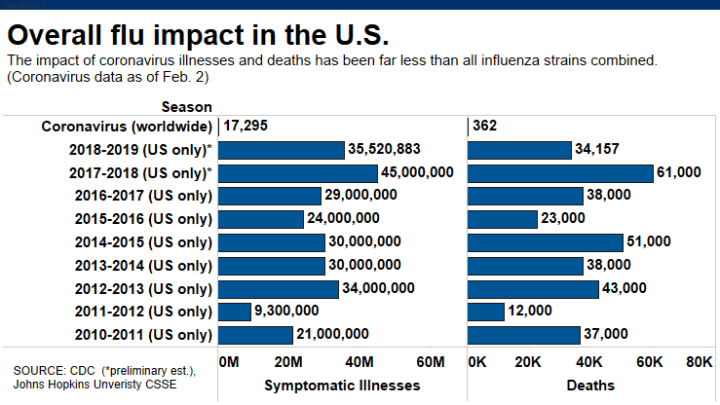

In the chart below, we see that the 2017 Flu had affected 45,000,000 Americans, and 61,000 Americans died. I don’t remember a single pizza shop, nail salon or restaurant closing – nor did anyone hoard toilet paper. As a matter of fact, I don’t remember any publicity, other than an occasional mention that the flu season was worse, that year, than other years. So, what happened to us as a society between 2017 and 2020? It was only 4 years ago.

The 2017 flu season had a death rate of 0.14%. There was no social distancing on a national basis, and I don’t remember our hospitals being at capacity in dealing with the flu that year. The economy was not shut down and the stock market was up 21.83%.

As of this date, there are currently about 75,000 Coronavirus cases confirmed in the U.S. – and rising as testing is being rolled out – and about 11,000 deaths. That’s a death rate of 14.67 percent; a scary number, but the data is misleading because it is incomplete. We won’t know the real number of confirmed cases and deaths for several months. Even if this is a more dangerous flu virus, experts agree that the real death rate will probably be between 0.30% to 0.50% when all the testing is done, and the virus has burned itself out.

Could it be possible that the reason our hospitals are at near capacity is that it’s also the regular flu season, and we are dealing with two different flu’s simultaneously? It would be interesting to see the regular flu data published alongside the Coronavirus data, to give us some insight into the hospital capacity problem.

Clearly, our social distancing and other mitigation policies will end this epidemic sooner than later, but at what price? As the fear of this virus diminishes there will be lots of philosophical debate about the price, we are willing to pay, to lower the death rate for future epidemics. That will affect the debate and policies going forward for medical insurance and the economy.

As I said in my previous updates, this is a short-term event. It won’t end abruptly; it will phase out in stages. In a few weeks we may begin to see the beginning of the end of this epidemic. The stock market is already anticipating a rebound in the economy in the fourth quarter. Today’s unemployment claims were reported at 3.2 million, however, the Senate has passed a $2 trillion recovery aide bill that the President will sign when he gets it from Congress. That’s good news for our needs now, but it may come with long-term complications for our economy which we will have to sort out later. We may already be entering a recession, but we won’t know that for at least the next two or three quarters.

Your Portfolios

You may have noticed more than normal trading activities in your portfolios. While we can’t control what the market will do, we can control the risk level in your portfolio by rebalancing. We have been selling bonds that have been increasing in value as interest rates have fallen to almost zero and buying equities that have lost value to keep your risk profile intact. In taxable accounts, we have opportunistically been selling positions with losses and replacing them with equivalent investments to capture losses that can be used when filing your 2020 tax returns in 2021.

Stay Connected

At R.W. Rogé & Company, Inc. we have always believed that communication is key, and now more than ever, staying connected with one another is extremely important. We are using social networks like Facebook, LinkedIn, Twitter and Instagram, to share our insights, including market updates, informative articles, motivational messages, and Rogé office happenings. Most importantly, connecting with us allows us to hear from you, and see updates about you and your loved ones!

Be sure to connect with us on these platforms so that you can stay up to date on timely information and keep in touch. Simply click on the buttons below to connect with us. We would love to hear from you!

Let’s all do our part in practicing social distancing and all the other mitigation policies suggested. Help others by staying in touch with those feeling isolated and in need of assistance. We will get through this together.

On behalf of our entire team, who are working successfully from their homes, we wish you all good health. We also want to thank you for your patience, while we work to successfully emerge from this temporary crisis together.

If you have any questions or concerns, please call the office (631) 218-0077 and leave a message. We will return your call promptly.

Sincerely,

Ronald W. Rogé

Chairman & CEO