By Steven Rogé, MBA, CMFC®, AIF®

Managing Director and CIO

Throughout U.S. stock market history, value investing has held an advantage over growth investing during various market cycles. In general, growth stocks consist of companies with future potential, while value stocks consist of companies that are undervalued. Historically, the technology sector has largely represented growth, while the financial services sector has largely represented value.

There is some comfort to maintaining a neutral positioning since returns and risk have been predictably in-line with history, and that works well when developing financial plans. However, we are always monitoring trends, and consistently looking for areas of opportunity when they present themselves.

In the world of investing, what’s in favor today will eventually change. Rarely does playing it safe provide outsized returns, but that is exactly what has transpired. In the past 12 months, prominent large-cap stock market indexes, like the S&P 500, have outperformed all the smaller company, and value-based counterparts such as the S&P 600 Small Cap and S&P 500 Value Indexes. That is not to say we don’t own any value stocks; we do, through ownership of S&P 500 index funds. As of now the S&P 500 has approximately 24% and 30% in value and growth respectively, with the remainder in core.

We have found that the S&P 500 Index Fund is a wonderful investment for our client portfolios. It is low-cost, tax-advantaged, highly diversified, and allows us to control the amount of cash in the portfolio. However, over the past year the diversification benefits have somewhat diminished. While it does own a diversified basket of 500 company stocks, the percentage of stocks that make up the top 10 holdings has grown dramatically to about 27%. Rapid increases in index concentrations generally occur near excess speculation and sometimes market tops.

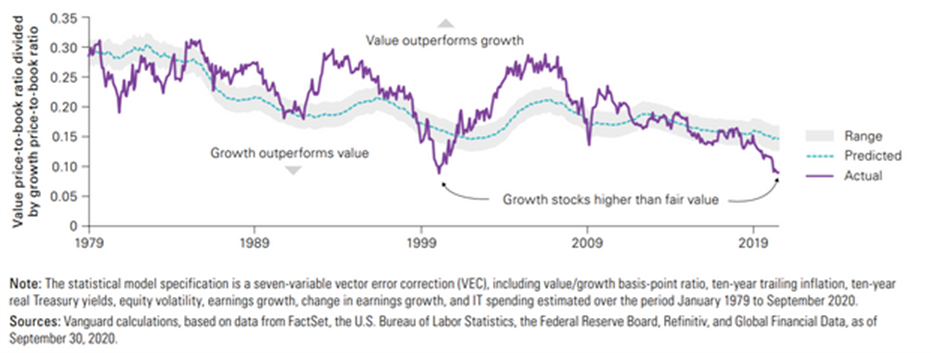

As you can see in the above chart. We have not experienced such a spread between growth and value stocks since 2000. We could debate all day long whether the stock market in 2000 is a good analogy for today’s market; it would not be meaningful since the solution is to avoid the most speculative portions of the stock market in favor of those areas that have been overlooked and perhaps undervalued. This reminds me of what the famous value investor, Warren Buffett once said, “In the short term, the stock market is a voting machine, in the long term, it’s a weighing machine.”

It is probably fair to say that the low interest rate environment and the Federal Reserve’s easy monetary policy have awakened animal spirits once again.

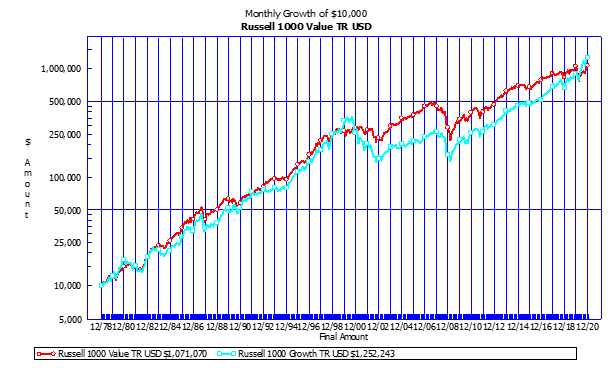

The chart below shows that value stocks tend to outperform growth stocks over longer periods of time. For the brief moments in history when growth stocks have outperformed, the reversal back to value stocks has been swift.

To prepare for a potential reversal between growth and value, we have identified investment vehicles that will allow us to capture an acceleration of this trend in our client portfolios.

If the new administration in Washington D.C. follows through with their promise of an infrastructure spending bill, this may be just the catalyst value stocks need to begin outperforming growth stocks. We cannot guarantee that our timing will be perfect, it almost never is, but we can always add to this position, as we see more evidence of a shift happening.

In the meantime, we encourage any questions you may have regarding this topic. Please feel free to reach out to us at 631-218-0077.