By Kelley Muhsemann

Communications and Marketing Manager

“I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.” – Jimmy Dean

Although the Covid-19 pandemic has caused many new policies like wearing masks, working remotely, and social distancing, the market volatility it has caused is not a novel issue. The markets – whether investors like to believe so or not – have always been unpredictable. In fact, a Vanguard case study from 2018 highlights what can happen when investors “jump ship” vs. those who “stay the course” when the markets look dire.

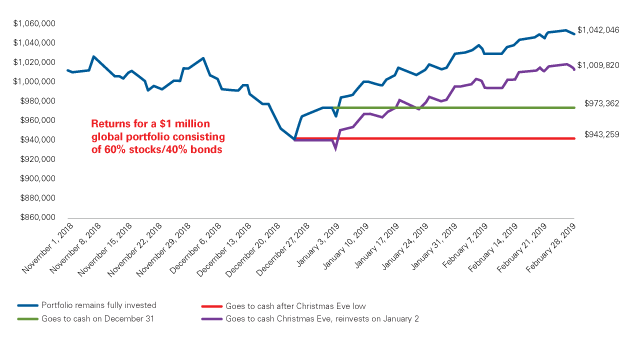

The chart below shows a hypothetical, diversified portfolio that started with $1 million on November 1, 2018. This portfolio would have lost 5.7% of its value by December 24 and would have jumped up 4.2% two months later.

An investor who reacted emotionally and sold the portfolio’s assets on Christmas Eve would have $100,000 less than an investor who stayed the course.

Source: Vanguard calculations, based on data from FactSet, as of February 28, 2019.

Source: Vanguard calculations, based on data from FactSet, as of February 28, 2019.

Unfortunately, “staying the course” has become so cliché within the financial industry that many investors cringe at the adage. Moreover, asking investors who are especially nervous about the market ups and downs to simply “do nothing” can be frustrating. Instead, our clients understand that although we cannot change the direction of the market, we can certainly “adjust our sails.” Highlighted below are four things to consider during times of market turbulence to help provide a sense of control.

1. Make Educated, Well-Informed Decisions

During the Covid-19 pandemic, we saw first-hand what happens when people panic. A virus that causes fever, cough, and respiratory issues, somehow made everyone run out and buy toilet paper in bulk. Instead of panicking about the market, one should strive to make educated, calculated, and well-informed decisions regarding your portfolio. Understanding your options and reviewing your long-term goals is often the first and usually the most helpful action you can take during periods of extreme volatility.

2. Review Your Risk Tolerance

Many investors who were once tolerant to risk, tend to be extremely risk averse when the markets act up. If you have already voiced your concerns with a trusted financial advisor, and still can’t sleep at night, consider a one notch reduction in your risk tolerance level – like switching from moderate risk to moderately conservative. This adjustment can help you feel more in control of your portfolio but is small enough that it won’t have a meaningful impact on the long-term projected outcome of your financial plan.

3. Automate and Rebalance

Automating your portfolio contributions can help remove the responsibility as well as the emotional aspect of trying to time your deposits during volatile markets. Automation can also build better financial habits and returns. Most investors know that trying to time the market is a fool’s game. This is not just a saying; it is backed by plenty of academic studies. Rebalancing your portfolio is another good way to control the risk. Rebalancing itself forces you to sell high and buy low. This practice, coupled with automation of the portfolio, is a very powerful tool that can increase returns over time.

4. The Bucket Strategy

Oftentimes just visualizing or refocusing on where your money is, and where it’s going can be helpful. Think about your cash needs over the next 12 months – that’s bucket number one. Then consider the next 8-12 years of financial needs – that’s bucket number two. Finally, bucket number three encompasses money needed for longer-term goals. Stocks are typically, used for longer-term goals because they are an important asset class to help you stay ahead of inflation and protect your future purchasing power. If your cash needs in the next 12 months have changed, contact your financial advisor to discuss and reevaluate your financial plan. But if everything is status quo, it’s likely that your portfolio will bounce back and keep you on track to achieve your goals.

We’ve already “adjusted our sails” to the Coronavirus by wearing face masks to the grocery store, washing our hands frequently, and visiting with family and friends virtually. Consider adjusting your financial sails with these four tips to help provide you with peace of mind, confidence, and a sense of control during uncertain times.

R.W. Rogé & Company, Inc. helps clients plan, achieve and live the life they want. To learn more about how we do this, click here. To discuss your financial future with a knowledgeable Senior Wealth Advisor, contact us at 631.218.0077 for a complimentary consultation.