Decoding tax and insurance jargon can be as difficult as learning another language. We recently encountered a scenario that helped our clients save money with a specific strategy for their Required Minimum Distributions (RMD) that will save significant Medicare Part B Premiums. If you or your spouse are nearing retirement, it’s a tip that might also assist your family.

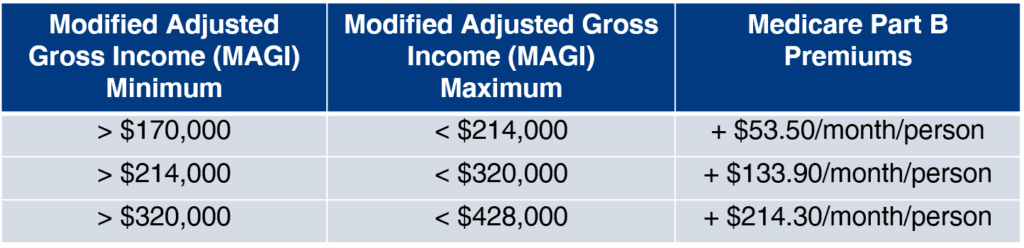

In this scenario, we assisted a couple who were both high wage earners and both retiring at age 70. We created the chart below to see how their Modified Adjusted Gross Income (MAGI) would impact their Medicare Part B Premiums.

With the knowledge that any substantial RMD’s can result in higher Medicare Part B Premiums, we advised the husband to defer his first RMD this year, and take two RMD’s the following year. We also advised his wife to hold off on taking her first RMD next year and take two RMD’s in the following year as well. This deferral strategy will result in keeping their combined Modified Adjusted Gross Income (MAGI) below $320,000 this year, and $214,000 next year. Without this strategy, they would have paid an additional $5,143.20 in Medicare Premiums in the first year, and an additional $3,213.60 in year two. This strategy saved them a total of $8,356.80 in Medicare Premiums. In the future, we will try and manage their income so that they don’t cross into a higher MAGI bracket.

For most people, Modified Adjusted Gross Income would be Adjusted Gross Income (AGI) plus tax exempt interest, plus the non-taxable portion of Social Security. If your total is below $170,000 for a married couple, your Medicare Part B Premium, as of now, is $134/month/person.

However, if your total goes above $170,000 – but is less than $214,000 – that would equal another $53.50/month/person. If your total goes over $214,000, that equals another $134/month/person. Lastly, a total over $320,000 would equal an additional $214/month/person.

If you have substantial income in retirement, it’s important to be aware of these brackets and their influence on Medicare Part B Premiums.

Regardless of your financial position in retirement, it’s important to consider how things like Medicare Part B Premiums and other various choices will affect your tax situation. Controlling the timing of income, capital gains, and IRA distributions can have a great impact during tax season.

To discuss your financial future with an experienced Senior Wealth Advisor, contact us at 631.218.0077 or send us a message by clicking here.