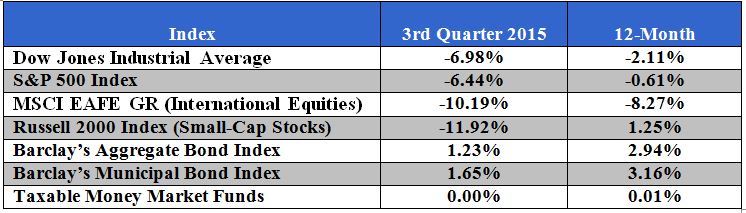

The third quarter was plagued by dropping commodities prices and major concerns over China’s slowing economy and its potential impact on the global economy. The Chinese equity markets entered into a bear market and subsequently the Chinese government attempted to intervene in the downturn, which only led to more concern. We saw double digit declines in global equities and domestic small cap stocks for the quarter. High quality domestic stocks fared slightly better down about 7% for the quarter.

As equity prices dropped we saw a flight to relative safe-havens such as fixed income securities. The potential for rising interest rates didn’t sway investors from driving yields down and prices for bonds up. Municipal bonds fared slightly better than their taxable counterparts, both up between 1-2% over the past three months.

Money Markets are still paying close to zero percent. Inflation rates are trending at around 1% in the U.S. for the third quarter and close to 0% for this year.

Major Market Indexes 1

Outlook and Strategy

We have been closely following the rapid drop in commodity prices and the subsequent effect on emerging markets and commodity producers. This could be the slight crack in the global economy that causes the next global recession. In addition, the Federal Reserve keeping interest rates so low has promoted risk taking. A decade ago excess leverage went into the housing market, but this time around it went into the commodities. Many companies with high costs sprung-up to take advantage of low borrowing rates and high commodity prices, and banks were happy to lend. Many banks are now exposed to the faltering commodities sector and any defaults in the industry could potentially ripple through the economy. That said, banks around the world are in a much stronger position today than they were in 2008 due to regulatory changes made by sovereign governments to strengthen their financial systems.

As it stands now the U.S. economy remains relatively healthy with the unemployment rate near decade lows, oil prices relatively cheap, and consumers spending steadily. Innovation is alive and well and we continue to see productivity gains. We have been rebalancing our portfolios as we normally do, but have decided to leave the sale proceeds in cash (Money Market) as we look for opportunities to present themselves. Our portfolios are now in a modestly defensive position, taking typical cash levels up to around 10% from our normal 3% to 5% weighting. We are waiting for an opportunity to reinvest cash in investments as we start to see signs that the impact of the commodities bust is limited. Once we see this we will act quickly to pick-up bargains in the investment markets as they present themselves.

If you would like to speak with a Senior Wealth Advisor at R.W. Rogé & Company, Inc., please contact us at 631.218.0077. It would be our privilege to serve you and your family’s needs.

1 Steele Mutual Fund Expert