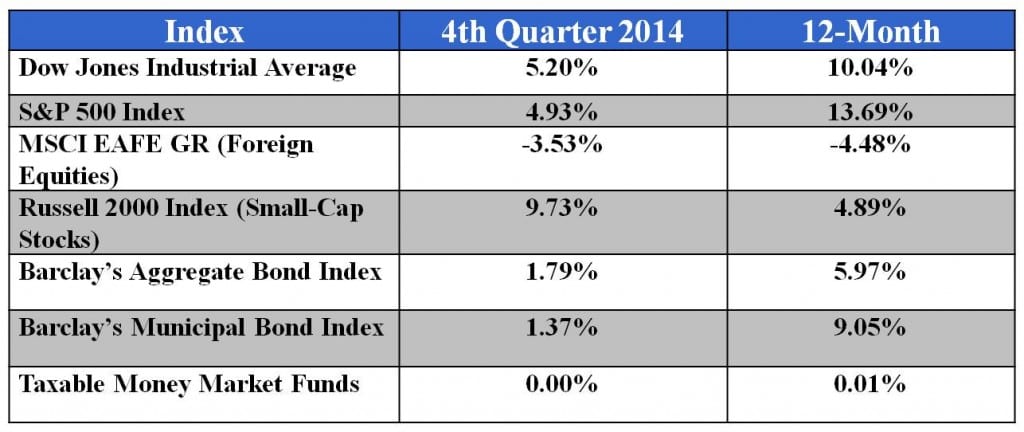

The domestic stock market performance in the fourth quarter of 2014 was solid. Foreign securities suffered as the strong U.S. Dollar and weak economies abroad weighed on investor’s returns. Smaller-company stocks played catch up with a strong performance in the fourth quarter, bringing returns back into positive territory for the year.

Overall, 2014 was another good year of positive returns, and was particularly interesting since diversifying one’s portfolio in anything but the S&P 500 meant lower returns. Even other large-cap indexes such as the Dow Jones Industrials Average couldn’t keep up with the S&P 500. A few large-cap stocks, such as Apple Inc., drove the price of the S&P 500 index to new record highs during the year.

The fixed income markets also produced positive returns. International investors are pouring money into U.S. Treasuries because they offer relatively higher yields. In fact, some European government debt is priced at levels which result in negative yields. Municipal bonds continued to do well as local economies recovered.

Major Market Indexes

Outlook and Strategy

Our overarching investment strategy remains unchanged; running globally allocated and diversified balanced portfolios with a value bias. However, our implementation and tactics for running such portfolios recently changed for 2015 and beyond. We will focus on reducing the underlying costs of the investments we use, eliminate the underlying cash drag from funds that let their cash balances build, and improve the tax efficiency of taxable portfolios.

We continue to believe that large-cap domestic stocks provide the best relative value and yield. We feel the best way to get exposure to this asset class is through the use of low-cost index or Exchange Traded Funds (ETFs). While we pride ourselves on the ability to find talented active managers, it’s important not to lose sight of an effective and tax-efficient strategy as well. We are not abandoning active management by any means, especially as we find new talent. However, the ability for active management to add value in the large-cap space is more limited. It’s therefore prudent to place a higher emphasis on low fees and tax efficiency in our client’s portfolios.

We are also lowering our exposure to direct investments in foreign stocks. While these investments have been big winners for our clients in the past, we recognize that a stronger U.S. Dollar presents a headwind for these investments. Since the Federal Reserve is likely to begin raising rates later this year, we expect that a strong U.S. dollar will persist for some time. In addition, our overweight in larger company stocks provides significant exposure to foreign revenues. Many large company stocks derive the largest portion of their revenues from overseas. By investing domestically, we still get the greatest property rights on earth with little or no currency headwind.

Capital Gains and Income Taxes

We have been living in a nearly perfect tax environment since 2008. We have not experienced significant capital gains distributions in many years due to the tax loss carry forwards we intentionally generated in 2008 and subsequent years. These tax loss carry forwards managed to offset any capital gains when we had them. Last year was the first year we began to see capital gains being distributed without the benefit of the loss carry forwards and ordinary losses to deduct from those gains. This year we expect to see even larger capital gains distributions as mutual funds experienced significant gains without the benefit of tax loss carry forwards. Therefore, be prepared for a tax bill that will be higher this year.

Please keep in mind that if you have to pay taxes on your investment portfolio, it’s because the portfolio is making money, which is never a bad thing.

If you would like to speak with a Senior Wealth Advisor at R.W. Rogé & Company, Inc., please contact us at 631.218.0077. It would be our privilege to serve you and your family’s needs.