2nd Quarter-2013 Review & Outlook

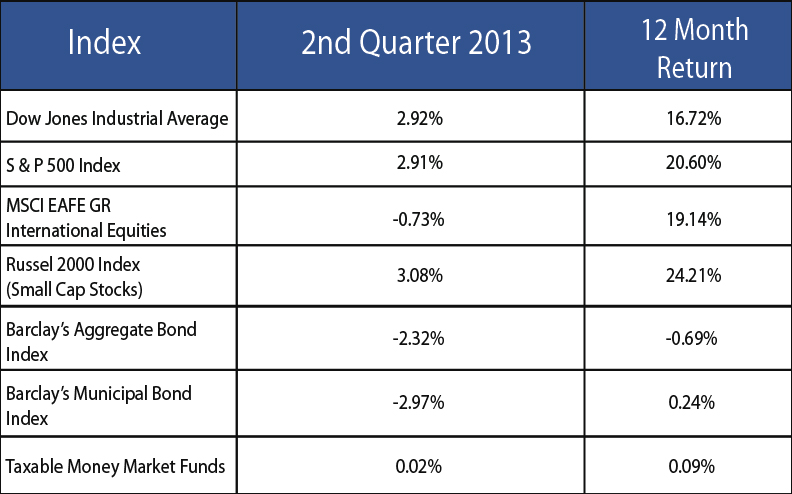

The second quarter of 2013 turned out to be relatively flat with stocks up about 2.9%, largely offset by a 2.3% decline in bonds.

For the quarter, large-cap stocks rose about 3% while smaller company stocks fared slightly better.

International stocks didn’t participate in the quarter and lost about 1%. This was in part due to a slowing Western European economy and to a sell-off in emerging market stocks which are highly influenced by the commodities market. Commodities were very weak during the quarter on fears that China’s economy is slowing.

The fixed income market had one of its worst quarters in nearly ten years as many investors seemed worried about an imminent rise in interest rates. The Federal Reserve sent confusing signals about how it would manage the removal of Quantitative Easing (QE) and the markets (stocks and bonds) reacted negatively. The Federal Reserve subsequently sent out spokesmen to try and clarify their remarks, which helped calm the markets.

Major Market Indexes

Outlook and Strategy

Our outlook for the global economy hasn’t changed much since the last report. That is, economic growth will remain somewhat muted. In the U.S. we expect to see modest growth (1.5% – 2.0% GDP), continuing a painfully slow upward trend. While certainly not the growth we need to see a meaningful improvement in the weak employment conditions, it is at least keeping us from falling back into a recession and hopefully moving us toward a more normal 3% to 4% growth rate in GDP. Unemployment should continue to slowly move downward due to the demographics of baby-boomers leaving the workforce, with many of those positions being replaced by technology.

We believe that high quality domestic large-company stocks with growing dividends remain one of the best places to invest in this environment. Many of these companies are able to pass along price increases to the end-consumer due to their strong brands and customer’s unwillingness to substitute a perceived inferior product or service.

Fixed Income remains an area of concern for us. There will be no more tailwinds from falling interest rates. Rather, there looks to be a multi-year period of progressively higher rates. We still view fixed income as an important “diversifier,” but we are being more selective in the areas within the fixed income market as well as reducing the duration of our fixed income allocation to help protect us during an eventual rise in interest rates.

While we don’t know where the stock market is going in any one quarter, year, or even three years, we do believe that the recovery in the housing market coupled with reasonable valuations in equities bodes well for risk bearing investors that are willing to focus on the long-term.

Those paralyzed by short-term fear and noise will likely be disappointed with their performance over the next decade as total returns on bonds and other fixed income instruments are unlikely to keep pace with the real rate of inflation.

Much has transpired since the great recession of 2008, and we have gained valuable insights, some new, some reconfirming. Patience, getting the facts, controlling one’s emotions when making decisions and having a globally, well-balanced portfolio based on ones goals and risk tolerance works, no matter how volatile the investment climate might be in the short-term. Having a longer-term view based on a financial plan anchors us to a solid decision making foundation.