By: Ron and Steven Rogé

It was a very good quarter for our portfolios. Investors brushed aside worries about Europe’s recession, China’s slowdown, and political stagnation to bid-up the price of stocks and high yield bonds. Having positions in stocks was well rewarded.

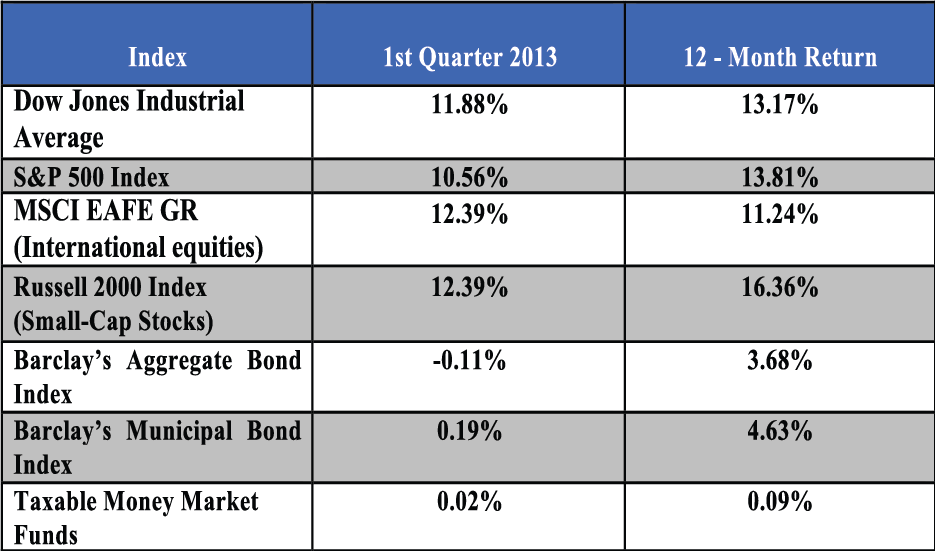

The S&P 500 increased 11% while smaller company stocks returned 12%. We saw strength in still controversial financial stocks, as well as, health care and consumer goods sectors of the equity markets.

International stocks were up 12%, making up for their lackluster returns the year prior. Japanese equities were big contributors as the Bank of Japan announced their own form of quantitative easing (QE). Japan’s easing will be three-quarters the size of the U.S.’s Federal Reserve QE, but on an economy only one-third the size of the U.S. Economy.

The bond market did not contribute to our portfolios this quarter. The Barclays Aggregate Bond Index was slightly negative in the first quarter as global economic fears abated. Municipal Bonds were essentially flat.

Commodities fared poorly despite renewed global growth. Gold lost about 5% for the quarter because of increased stability of the global economic picture.

Cash And Money Market Fund’s returns remain subdued do to the government’s artificially low interest rate policies.

Outlook and Strategy

Our outlook for the global economy is that it will remain somewhat muted. In the U.S. we will continue to see slow growth, 1.5% – 2.0% Gross Domestic Product (GDP), continuing its painfully slow upward trend. While certainly not a stellar picture of prosperity, it may be enough to keep our economy moving and eventually getting back on track to a more normal 3% to 4% GDP.

Europe is currently in a recession, but one that is well contained and seems to have bottomed. Any economic information to the positive might bring to life the European stock markets.

We are cautiously optimistic that this all bodes well for stocks; however, we remain more cautious on what an improvement in the economy might mean for fixed income, especially treasury bonds whose yield remains near all-time lows.

We continue to add to higher quality mutual funds with exposure to dividend paying stocks. We believe this strategic allocation decision will provide better risk adjusted returns than the fixed income market going forward. However, by no means are we abandoning fixed income, there remains selective opportunities within the fixed income market such as lowering the bond portfolio’s duration, emerging market debt, non-agency mortgage backed securities, ultra short-term high yield and alternative securities with fixed income like risk/reward ratios. In addition, fixed income securities provide a much needed buffer in the portfolio over the longer term by providing proper asset allocation and securities diversification.

Summary

On behalf of the entire team, we are pleased to report positive returns for the quarter and the last 12 months. We thank you for the confidence you have placed in us by allowing us to guide you and your loved ones during these very challenging times. It has been, and continues to be, our privilege to serve you and your family’s needs.