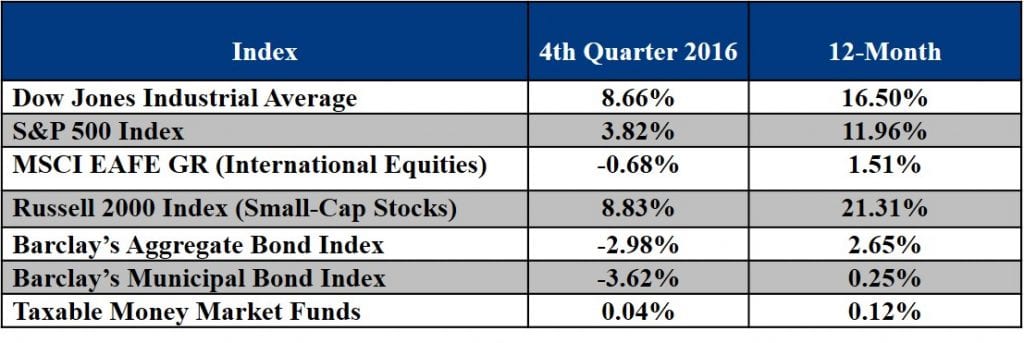

The stock market rallied 3.82% in the fourth quarter and almost 12% for the year. This is quite an amazing achievement considering that in January, stocks lost 5%, and were down nearly 10% for a short period during the month.

Swings in return were even more dramatic for smaller company stocks as they crossed the technical definition for a bear market in January, only to come back and be up over 21% for the year. Smaller company stocks had an impressive fourth quarter returning about 9%, and participated the most after the post-election rally.

International stocks missed out on the rally. They were down about 1% for the quarter and closed the year up 1.5%. They were hurt by geo-political events such as Brexit and a stronger U.S. Dollar. The GDP growth rates on many developed foreign nations remained flat while U.S. GDP continued to improve slowly.

In the fixed income market, The Barclays Aggregate Bond index lost 3% in the fourth quarter, but was up 2.7% for the year. The fourth quarter slump can be attributed to higher interest rate expectations going forward. Municipal bonds dropped almost 4% in the fourth quarter and were flat on the year. Municipal bonds suffered a double dose of disappointment as interest rates rose, and potential lower tax rates made their tax-free status slightly less attractive for those in the higher tax brackets.

Money Markets are still paying close to nothing, while inflation rates are trending at around 1% in the U.S. for the fourth quarter, and close to 0% this year.

Major Market Indexes

Outlook and Strategy

What a year it has been. There were expectations for slow growth, gradually rising interest rates, and a stable but strong U.S. dollar. Those expectations changed on Election Day when Donald Trump won the presidential election. The market rallied on new expectations of a fiscal policy that includes lower taxes for individuals and corporations, infrastructure spending, fewer business regulations and a host of other pro-growth anticipations. Our Investment Committee has been discussing what will change under a Trump Administration. We have been patiently watching his cabinet appointments to gauge what might be in store for future fiscal reform.

While President-elect Trump has discussed many different topics over the course of the campaign, it seems the Trump Administration will focus on three things this year. First, the repeal and replacement of the Affordable Care Act. This has ramifications for your portfolio as certain sectors will be affected, some positively and some adversely. Second, tax reform, both personal and corporate. It looks like taxes across the board will be going down some time in the fourth quarter of 2017 as some version of Sen. Paul Ryan and Trump’s tax plan gets negotiated. Third, lower regulation as Trump has brought on his Administration free-market supporters that look to reform regulation in the energy, health care, and financial industries.

It seems the Federal Reserve has taken notice to the proposed fiscal stimulus and expanded their expectations of increasing interest rates. This coupled with the prospect of increased Treasury bond issuance to support lower taxes and reduced government revenue has changed our expectations of the trajectory of rising interest rates from slow and steady to a faster pace. It is economics 101 – a larger supply of bonds means lower prices for the bonds. This means we need to take a more cautious stance of bond positions going forward for less interest rate risk.

We have not had fiscal stimulus in many years, and prior Administrations focused elsewhere. Extra stimulus to our already tight labor force will likely cause inflation, something we haven’t seen in a meaningful way since the turn of the century. With inflation comes corporate revenue growth – something else we haven’t seen in a while – as most companies have focused on cost cutting and efficiency in this slow growth environment. Business sentiment indicators suggest this is changing rapidly as businesses are planning to spend to grow.

We are making tactical adjustments to all of our asset allocation risk categories as well as diversifying away from bonds that are more interest rate sensitive to ones that have the potential to outperform as the economy continues to improve.

As we discussed in our recent client communication, there is a major shift taking place in the economy as the 35-year bull market in bonds is in the process of reversing itself. This will play out over many years, and is good for our portfolios over the long-term. The economy is moving back to a more “normal” environment from what had been labeled as “The New Normal” about a decade ago. Think of this as a ship that has been sailing in uncharted waters for about a decade making the transition back into charted waters. The transition can be turbulent at times, but the captain’s confidence increases as the ship approaches familiar waters.

As we navigate through this transition we will keep you advised of our strategies and tactics for achieving reasonable risk-adjusted returns as we have done for more than 30 years.

If you would like to speak with a Senior Wealth Advisor at R.W. Rogé & Company, Inc., please contact us at 631.218.0077 or at info@rwroge.com, or simply click here. It would be our privilege to serve you and your family.