Second Quarter 2016 Review

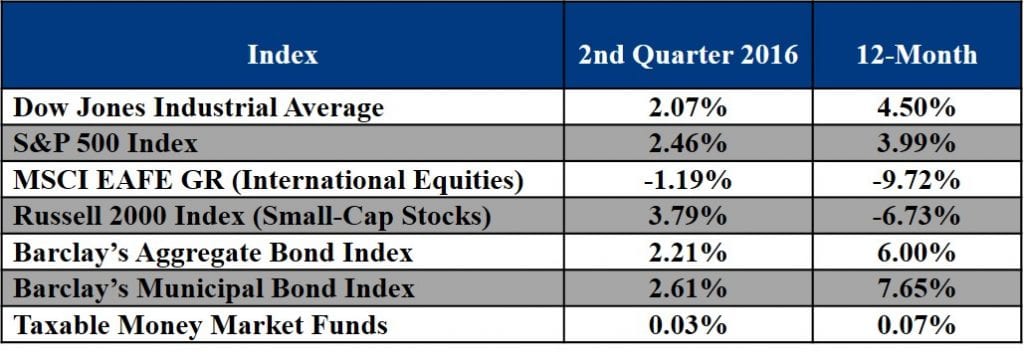

The market recovered through the second quarter of 2016 after a poor performance in the month of January. Fear is subsiding as the economic picture here in the U.S. slowly improves. Large-cap stocks rose about 2.5% for the quarter and are up 3.8% for the year.

Smaller company stocks rose 3.9% for the quarter and are up 2.4% for the year to date. International equities lost 2% for the quarter and are down more than 4% since January.

In the fixed income market, The Barclays Aggregate Bond index which is heavily weighted in Treasuries gained about 2.2% and is up over 5% for the year so far. Treasuries are defying most investors expectations by declining in yields and increasing in price. Meanwhile municipal bonds are improving, returning about 2.5% for the second quarter and up 4% for the year as investors seek out tax-free income.

Money Markets are still paying close to 0%, while inflation rates are trending at around 1% in the U.S. for the third quarter, and close to 0% this year.

Major Market Indexes

Outlook and Strategy

We continue to favor larger company domestic stocks over their smaller and foreign counterparts. Our investment strategy is and always has been to obtain the best risk-adjusted rate of return for client portfolios based on their risk tolerance and time horizon. We believe U.S. companies are better positioned than companies in other countries to flourish over time. Much of our philosophy has to do with property rights, a well-developed infrastructure, a diversified economy, and a culture for creativity and entrepreneurship, all of which bode well for future returns.

Focusing on domestic equities also allows us to reduce costs within the portfolio since international and smaller company investment vehicles typically charge more for those strategies. In addition, the diversification benefits of owning international securities has been reduced over the years as companies from the U.S. now derive close to 50% of their revenue from overseas. Any additional international equities added to the portfolio would lead to a large overweight toward international revenue streams and their associated currency risks.

While global yields on fixed income decline, dividend paying stocks will look more attractive compared to their bonds. In some cases, the yield from higher-quality stocks are greater than their own bond yields. This is a rare occurrence and is unlikely to persist.

While Treasury yields remain near all-time lows, they are still very attractive compared to negative interest rates in many developed economies overseas. This should provide a tailwind to intermediate-term fixed income indexes that are heavily weighted toward Treasuries. Municipal bonds are modestly attractive as the prospects for higher income tax rates in the future seem likely, making tax-free income more appealing.

As always, we remain cautious with our investment strategy. While there are more opportunities today than in the beginning of the year, the stock market remains fully valued. We will maintain a larger than normal cash position (3% to 5%), currently about 9% to 12% in our portfolios as we wait for opportunities to arise to redeploy these assets.

If you would like to speak with a Senior Wealth Advisor at R.W. Rogé & Company, Inc., please contact us at 631.218.0077 or at info@rwroge.com, or simply click here. It would be our privilege to serve you and your family.